Our venture model - Truestone

INSIDE OUR VENTURE MODEL

We believe providing access to capital has the ability to shape futures —

and where it flows, change often follows

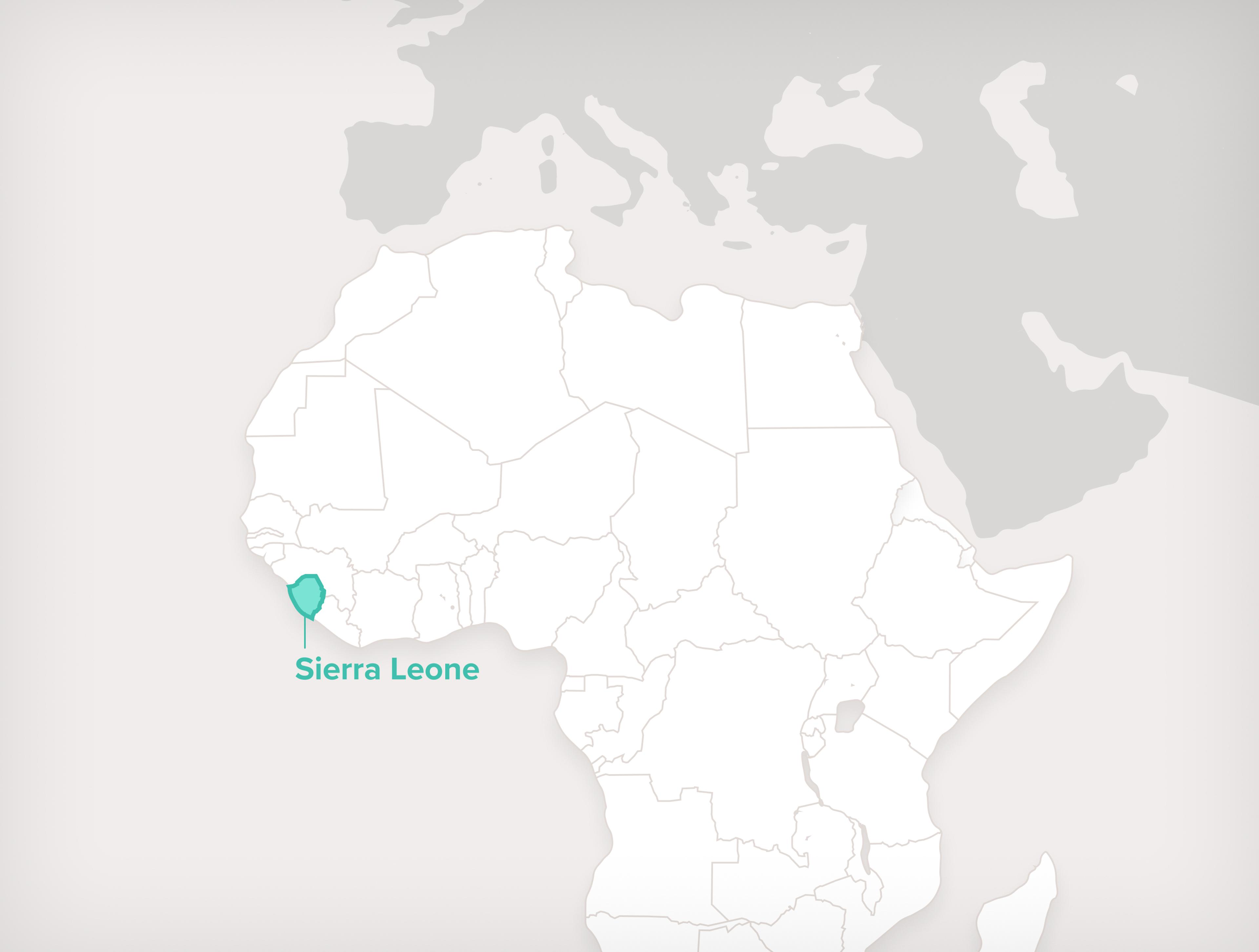

At Truestone, every investment is a commitment to people and the country of Sierra Leone. Venture building goes beyond simply investing in companies.

When investment reaches the right people, in the right places, it doesn’t simply have the ability to accelerate businesses — it also helps to reshape futures.

This is why we focus on growing strong aligned relationships and at an operating level building synergies across our portfolio to improve resilience and unlock greater growth potential. By connecting experience with resources across our portfolio’s ecosystem, we are able to create greater efficiencies, accelerate innovation, and enable our businesses to adapt and thrive in a complex environment.

FROM SEED TO SCALE

Our approach combines two unique strategies to drive value creation:

VENTURE BUILDING

INCUBATE, SEED AND SCALE START-UPS WITH TRUSTED LOCAL EXECUTIVES - BUILDING LOCALLY GROUNDED SOLUTIONS

SYSTEMS-THINKING

DEVELOP SYNERGIES BETWEEN PORTFOLIO COMPANIES TO BUILD RESILIENCE AND ENHANCE GROWTH

WHO AND WHAT WE INVEST IN

Large addressable domestic markets

We invest in purposeful businesses which are addressing urgent needs in underserved markets.

Financial Inclusion

Expanding access to tools that help people plan, grow, and protect their livelihoods.

Food Security & Agribusiness

Building stronger food systems — from production to market.

Basic Goods & Services

Backing businesses that bring quality food and everyday services closer to the people.

Building Work Opportunities

Creating dignified, sustainable jobs through skills, training, and innovation.

Climate Resilience

Enabling solutions that protect people and resources in a changing environment.

OUR PORTFOLIO IN SIERRA LEONE

Seven high-impact and interconnected companies

OUR APPROACH

We go beyond providing capital

For us, creating an impact investment is not simply a transaction — it is a long-term journey.

We back talented teams with patient capital, and we also bring hands-on support, operational depth, and a long-term mindset.

We work collaboratively with our executive teams to scale businesses from seed.

We drive business development in five key areas:

Strategy: shaping clear, context-driven roadmaps together.

Partnerships: unlocking networks and coalitions that accelerate growth.

People development: supporting executives and teams with the tools and training to lead.

Fundraising: connecting ventures with private and institutional capital.

ESG: embedding responsible practices that sustain long-term impact.

COMMON QUESTIONS

About Truestone's Investment Strategy

How does impact investing differ from traditional investing?

How does impact investing differ from traditional investing?

Impact investing differs from traditional investing in that it seeks both a financial return and intentional, measurable positive social and/or environmental outcomes, whereas traditional investing focuses primarily on financial performance.

How do you measure impact?

How do you measure impact?

We combine internationally recognized ESG and SDG frameworks with our own Three Pillar Scorecard to track financial performance, impact outcomes, and governance growth. We publish results in our annual Impact Report.

How do you support entrepreneurs beyond capital investment?

How do you support entrepreneurs beyond capital investment?

We take a hands-on approach, engaging weekly with portfolio teams. Our support includes co-developing strategy, facilitating training and partnerships, and strengthening governance.

What is your investment structure?

What is your investment structure?

Truestone operates a UK-based holding company with significant stakes in each portfolio business. Historically, it has also facilitated direct equity investment into individual companies.

What is your investment timeline?

What is your investment timeline?

Our model blends patient capital with market rate expectations. We seek value through mid-term dividends and long-term exit strategies, aligned with business maturity and market conditions.

EXPLORE

Our Venture Model

More than capital. We build businesses for the long term.

Our Identity

Inspired by faith and purpose.

Backed by experience.

Our Impact

It is not simply about numbers but the detail and the lives behind the numbers.